Silicon carbide (SiC) technology continues to make waves, this time with multi-supplier and multi-country material sourcing agreements amid the rising demand for power semiconductors in automotive, solar, and electric vehicle (EV) charging applications. Two leading vendors of SiC power semiconductors—Infineon and onsemi—have signed multi-year agreements to bolster the manufacturing supply chain in May 2023.

That marks a new trend in the semiconductor industry: vertically integrated companies investing heavily to expand their SiC capacity while bolstering the end-to-end component supply chain. SiC power semiconductors, pivotal in 800-V EV designs for their ability to facilitate fast and convenient high-voltage charging, are fueling a worldwide power electronics boom.

Take the 10-year supply agreement worth $1.9 billion between onsemi and Vitesco Technologies, a manufacturer of modern drive technologies and electrification solutions. Vitesco will also invest $250 million in onsemi’s SiC supply chain operations for new equipment encompassing SiC boule growth, wafer production and epitaxy, thus securing access to SiC capacity for future projects.

In other words, this equipment will be used to produce SiC wafers for Vitesco’s increasing demand for SiC devices. The Phoenix, Arizona-based onsemi is currently supplying EliteSiC MOSFETs for Vitesco’s traction inverters and EV drives.

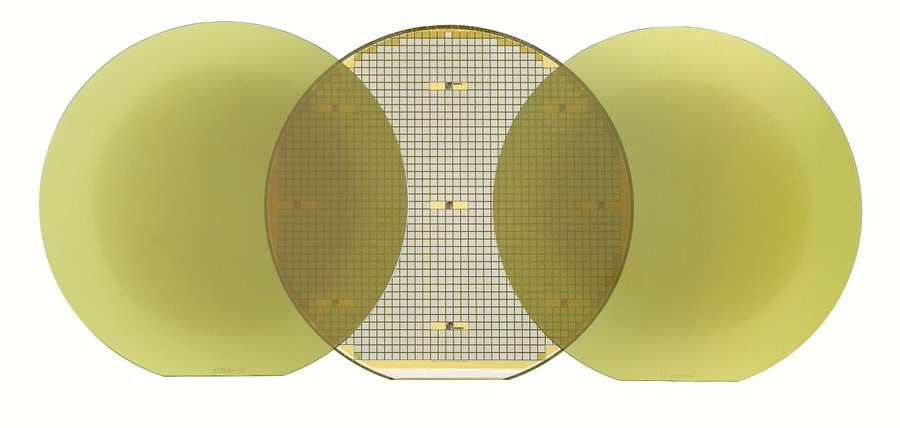

Figure 1 Long-term supply agreements underscore SiC’s pivotal role in ramping electrification. Source: Vitesco Technologies

“Energy-efficient silicon carbide power semiconductors are at the beginning of a big surge in demand,” said Andreas Wolf, CEO of Vitesco Technologies. “That is why it is imperative for us to get access to the complete SiC value chain together with onsemi.” Vitesco is also teaming up with onsemi for optimized customer solutions and thus address customers’ demand for longer range and higher performance in EVs.

A SiC supply pact in China

A few weeks before onsemi’s deal announcement, Infineon consolidated its SiC material supplier base by signing a long-term pact with China’s SICC to secure additional competitive SiC sources. SICC will supply Infineon with 150-mm wafers and boules to manufacture SiC semiconductors.

While the first phase of the SICC deal will focus on 150-mm SiC wafers, the supply deal is expected to move to 200-mm wafers eventually. The German chipmaker—which aims to capture 30% of global SiC market by the end of the decade—is planning to boost its SiC manufacturing capacity tenfold by 2027.

Figure 2 SiC semiconductor suppliers are diversifying their supplier base for wafers and boules. Source: Infineon

The sourcing deal with a wafer and boules supplier in China also underscores Infineon’s plans to cater to a broad market. “Infineon is significantly expanding its manufacturing capacities at its production sites in Malaysia and Austria in order to serve the growing SiC demand,” said Angelique van der Burg, chief procurement officer at Infineon.

As part of this strategy, Infineon’s plant in Kulim, Malaysia is scheduled to start SiC production in 2024, adding to its manufacturing capacities in Villach, Austria.

Related Content